|

|

|

THOMSON REUTERS WEEKLY TAX BULLETIN

Issue 40, 6 OCTOBER 2020

SPECIAL ISSUE - 2020 FEDERAL BUDGET REPORT

[With special comments by Reuters News]

|

|

TABLE OF CONTENTS 1

EXECUTIVE SUMMARY

| [1067] | 2020-21 Federal Budget: "all about jobs"; record deficit, big spending, backdated tax cuts and more

|

| [1068] | Australia to run record budget deficit as govt cuts tax, boosts job support

- by Sam Holmes and Colin Packham, Reuters News |

PERSONAL TAXATION

| [1069] | Personal tax cuts (Stage 2) brought forward to 1 July 2020; Stage 3 unchanged for 2024-25

|

| [1070] | Low income offsets - new LITO brought forward to 2020-21 and LMITO retained for 2020-21

|

| [1071] | Targeted CGT exemption for "granny flat" arrangements

|

| [1073] | Tax exemptions for short-term IMF and World Bank missions

|

BUSINESS TAXATION

| [1074] | Small business tax concessions extended to businesses in $10m-$50m range

|

| [1075] | Outright deduction of capital assets until 30 June 2022 for most businesses

|

| [1076] | Loss carry-back from 2019-20, 2020-21 and 2021-22 income years

|

| [1077] | Instant asset write-off: minor change only, but limited relevance

|

| [1078] | Despite Budget outright deduction changes, depreciation rules still relevant

|

| [1079] | Corporate residency test to be clarified

|

| [1080] | FBT exemption for retraining redeployed employees

|

| [1081] | FBT record-keeping - reducing compliance burden

|

| [1082] | R&D Tax Incentive changes announced and start date deferred

|

| [1083] | State COVID-19 business support grants - NANE income

|

| [1085] | Supporting small business and responsible lending

|

| [1086] | Film Producer Offset changes confirmed

|

| [1087] | List of information exchange jurisdictions updated

|

SUPERANNUATION

| [1088] | Super reforms: accounts to be stapled to members; best financial interests duty; other

|

| [1089] | Super Guarantee: no change to rate increase set for July 2021

|

OTHER MEASURES

| [1090] | Wage subsidy for new apprentices

|

| [1091] | First Home Loan Deposit Scheme: additional 10,000 places

|

| [1092] | Additional funding for ATO to fight serious crime

|

| [1093] | Additional funds for foreign investment application processing

|

| [1094] | Business Innovation and Investment Program to be streamlined

|

| [1095] | Customs duty: free rate for COVID-19 related medical products extended

|

SOCIAL SECURITY MEASURES

| [1096] | $250 cash payments for income support recipients

|

| [1097] | Deeming rates – no change

|

| [1098] | Youth Allowance and ABSTUDY eligibility: incentives re seasonal work

|

| [1099] | Youth Allowance and ABSTUDY independence test

|

| [1100] | Cashless Debit Card - ongoing funding

|

| [1101] | Paid Parental Leave – alternative work test

|

| [1102] | Totally and Permanently Incapacitated Veterans - rent assistance

|

APPENDIX: BILLS BEFORE PARLIAMENT

| [1103] | Parliament resumes sitting: outstanding tax, super and related Bills

|

|

|

EXECUTIVE SUMMARY

[1067] 2020-21 Federal Budget: "all about jobs"; record deficit, big spending, backdated tax cuts and more

| [1067] |

2020-21 Federal Budget: "all about jobs"; record deficit, big spending, backdated tax cuts and more

|

On Tuesday, 6 October 2020, Treasurer Josh Frydenberg handed down the 2020-21 Federal Budget, his 2nd Budget. He said the Budget was "all about jobs" (including creating new jobs and getting the unemployed back into work again) and getting the economy moving again.

The Treasurer said "COVID-19 will see the deficit reach $213.7 billion this year, falling to $66.9 billion by 2023-24". He said net debt will increase to $703 billion or 36% of GDP this year and peak at $966 billion or 44% of GDP in June 2024.

The Treasurer said that the economy is forecast to fall by 3.75% this calendar year and unemployment to peak at 8% in the December quarter. Next calendar year, he said the economy is forecast to grow by 4.25%, and unemployment to fall to 6.5% by the June Quarter 2022.

In addition, the 2020-21 Budget expands the Government's 10-year infrastructure pipeline to $110 billion.

On personal taxation, in an expected announcement, the Government confirmed that the previously legislated Stage 2 tax cuts will be brought forward by 2 years, from 1 July 2022 to 1 July 2020 ie they will be brought forward and backdated - see below.

Revenue measures announced

The major revenue measures announced in the Budget included:

-

Bring forward of the second stage of the personal tax cuts by 2 years to 1 July 2020, lifting the 19% threshold from $37,000 to $45,000, and lifting the 32.5% threshold from $90,000 to $120,000. At the same time, the low and middle income tax offset (LMITO) will be retained for 2020-21.

-

The Stage 3 personal income tax cuts remain unchanged and will commence in 2024-25 as already legislated.

-

Loss carry-back: The Government will allow eligible companies to carry back tax losses from the 2019-20, 2020-21 or 2021-22 income years to offset previously taxed profits in 2018-19 or later income years.

-

Asset write-off: For eligible capital assets acquired from 7:30pm AEDT on 6 October 2020 and first used or installed by 30 June 2022, over 99% of businesses will be able to write off the full value of any eligible asset they purchase for their business. This will be available for small, medium and larger businesses with a turnover of up to $5 billion until June 2022.

-

Corporate residency test to be clarified: The Government will make technical amendments to clarify the corporate residency test. It will amend the law to provide that a company that is incorporated offshore will be treated as an Australian tax resident if it has a 'significant economic connection to Australia'. This test will be satisfied where both the company's core commercial activities are undertaken in Australia and its central management and control is in Australia.

-

Superannuation: Several measures were announced. Commencing on 1 July 2021, the Your Future, Your Super package will see the following changes:

-

YourSuper portal - the ATO will develop systems so that new employees will be able to select a super product from a table of MySuper products through the YourSuper portal;

-

stapled accounts - an existing super account will be "stapled" to a member to avoid the creation of a new account when that person changes their employment;

-

MySuper benchmarking - from July 2021, APRA will conduct benchmarking tests on the net investment performance of MySuper products, with products that have underperformed over two consecutive annual tests prohibited from receiving new members until a further annual test that shows they are no longer underperforming;

-

super trustees - best financial interests duty - the Government will legislate to compel super trustees to also act in the best "financial" interests of their members. The Government will also require super funds to provide better information regarding how they manage and spend members' money in advance of Annual Members' Meetings.

-

R&D: For small companies, those with aggregated annual turnover of less than $20 million, the refundable R&D tax offset will be set at 18.5 percentage points above the claimant's company tax rate, and the $4 million cap on annual cash refunds will not proceed. For larger companies, those with aggregated annual turnover of $20 million or more, the Government will reduce the number of intensity tiers from 3 to 2.

-

ATO funding: The Government will provide $15.1 million to the ATO to target serious and organised crime in the tax and super systems.

-

JobMaker hiring credit: The Government announced a new JobMaker hiring credit to encourage businesses to hire younger Australians. The JobMaker hiring credit will be payable for up to 12 months and immediately available to employers who hire those on JobSeeker aged 16-35. It will be paid at the rate of $200 per week for those aged under 30, and $100 per week for those aged between 30-35. New hires must work for at least 20 hours a week. All businesses, other than the major banks, will be eligible.

- The Government has committed to creating 100,000 new apprenticeships.

-

Age Pensioners will receive an additional $250 payment from November 2020 and a further $250 payment from early 2021.

As previously announced, the Budget confirmed:

- A targeted CGT exemption for granny flat arrangements.

- Expanded access to a range of small business tax concessions (eg start-up expenses, FBT exemptions on car parking, access to simplified trading stock rules) by increasing the small business entity turnover threshold for these concessions from $10 million to $50 million.

- An FBT exemption for employer provided retraining and reskilling benefits provided to redundant, or soon to be redundant, employees where the benefits may not be related to their current employment.

- The ATO will have the power to allow employers to rely on existing corporate records, rather than employee declarations and other prescribed records, to finalise their FBT returns.

- The Victorian Government's business support grants for SMEs will be non-assessable non-exempt (NANE) income for tax purposes.

The Budget also includes a package of measures to create jobs and back regional Australia's economic recovery:

- $2 billion in concessional loans to help farmers overcome the drought;

- $350 million to support regional tourism to attract domestic visitors back to the regions and a further round of the Building Better Regions Fund; and

- $317 million for Australian exporters to continue to access global supply chains.

Where to get Budget documents

The 2020-21 Budget Papers are available from the following website:

|

[1068] Australia to run record budget deficit as govt cuts tax, boosts job support - by Sam Holmes and Colin Packham, Reuters News

| [1068] |

Australia to run record budget deficit as govt cuts tax, boosts job support

-

by Sam Holmes and Colin Packham, Reuters News

|

SYDNEY, Oct 6 (Reuters) - Australia pledged billions in tax cuts and measures to boost jobs in its 2020-21 Federal Budget on 6 October 2020 to help pull the economy out of its historic COVID-19 slump in a budget that tips the country into its deepest deficit on record.

The Government has unleashed $300 billion in emergency stimulus to prop up growth this year, having seen the coronavirus derail a previous promise to return the budget to surplus. Treasurer Josh Frydenberg announced $17.8 billion in personal tax cuts and $5.2 billion in new programmes to boost employment in a recovery plan aimed at creating one million new jobs over the next 4 years.

Those measures are forecast to push the budget deficit out to a record $213.7 billion, or 11% of gross domestic product, for the fiscal year ending 30 June 2021. Total 2020-21 revenues are estimated to fall to $472.4 billion, or 24.3% of GDP.

"There is no economic recovery without a jobs recovery," Frydenberg said in prepared remarks to Parliament. "There is no budget recovery without a jobs recovery."

Australia's unemployment rate hit a 22-year high of 7.5% in July as businesses and borders closed due to strict lockdown measures to deal with the coronavirus.

While the number of deaths and infections in Australia from COVID-19 has been low compared with many other countries, the hit to GDP has been severe. Underlying the budget forecasts was an assumption that a vaccine would be developed in 2021.

Australia's $2 trillion economy shrank 7% in the 3 months ended June, the most since records began in 1959.

In its new projections, the Government expects unemployment to rise to 7.25% by the end of the current fiscal year and then fall to 6% by June 2023. Australia's GDP is expected to shrink 1.5% for the current fiscal year before returning to growth of 4.75% in the next.

S&P Global Ratings said Australia remained only one of 11 countries with the highest credit rating of AAA, albeit with a negative outlook, and said fiscal recovery would take years.

"While debt is markedly higher than the past, servicing costs remain manageable, as the interest-rate environment will remain favourable for a number of years," said Anthony Walker, a director at the rating agency.

Gross debt is projected to surpass A$1 trillion in 2021-22, from A$684 billion in 2019-20, and then rise to around A$1.14 trillion by 2023-24.

Jobs push

The Government said it will spend $4 billion over the next year to pay businesses that hire those under the age of 35 as it targets youth unemployment.

The Budget also brings forward previously legislated tax cuts for middle-income earners and extends tax breaks for individuals offered in last year's budget for low- and middle-income earners. Some of these cuts will be retrospectively backdated to 1 July 2020.

The Government's highly expansionary budget comes shortly after the central bank's policy decision on 6 October 2020, at which it kept interest rates at a record low and flagged reducing high unemployment rate as a national priority.

The Reserve Bank of Australia has slashed interest rates this year to 0.25% and pumped billions into the bond market to keep credit flowing to the economy.

The fiscal and monetary support this year has helped restore consumption and business confidence and bring the unemployment rate down to 6.8%.

Frydenberg has pledged to pare the heavy fiscal support once the unemployment rate falls "comfortably below 6%".

Australia delayed the release of this year's Federal Budget, which usually takes place in May, as the coronavirus upended most of the economic assumptions underlying its projections.

While many of the measures announced in the Budget were not new, the Government affirmed its strategic priorities that include boosting domestic energy production and manufacturing and infrastructure investment. Frydenberg said the plans would "ensure Australian manufacturing plays an even greater role in our economic recovery". (Reporting by Sam Holmes, Colin Packham and Swati Pandey, editing by Ed Osmond)

|

PERSONAL TAXATION

[1069] Personal tax cuts (Stage 2) brought forward to 1 July 2020; Stage 3 unchanged for 2024-25

| [1069] |

Personal tax cuts (Stage 2) brought forward to 1 July 2020; Stage 3 unchanged for 2024-25

|

In the Budget, the Government announced that it will bring forward to 1 July 2020 the personal tax cuts (Stage 2) that were previously legislated in 2018 to commence from 1 July 2022. The Stage 3 tax changes remain unchanged and commence from 1 July 2024, as previously legislated:

-

Stage 2 tax rates – was 1 July 2022, now 1 July 2020

-

Stage 3 tax rates – unchanged - to commence on 1 July 2024, as previously legislated

Bringing forward personal tax cuts (Stage 2)

The Government will bring forward the Stage 2 personal income tax cuts to 1 July 2020 (from 1 July 2022, as previously legislated in 2018). The Treasurer said this will see more than 11 million taxpayers get an immediate tax cut backdated to 1 July 2020.

From 1 July 2020,

- the top threshold of the 19% personal income tax bracket will increase from $37,000 to $45,000;

- the top threshold of the 32.5% tax bracket will increase from $90,000 to $120,000.

The new low income tax offset (maximum $700) has also been brought forward to 2020-21, while the low and middle income tax offset (maximum $1,080) has been retained for 2020-21: see para [1070] of this Bulletin.

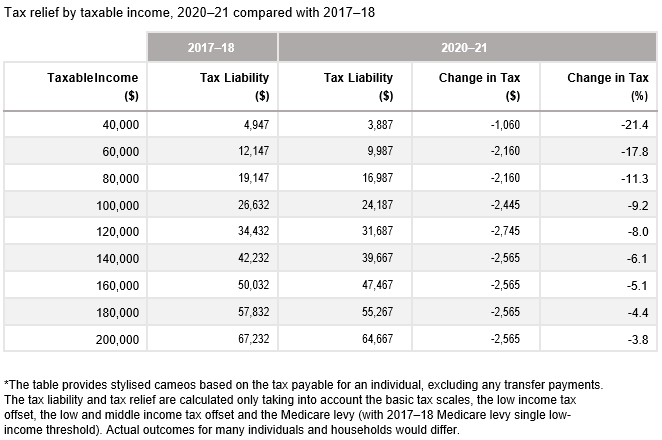

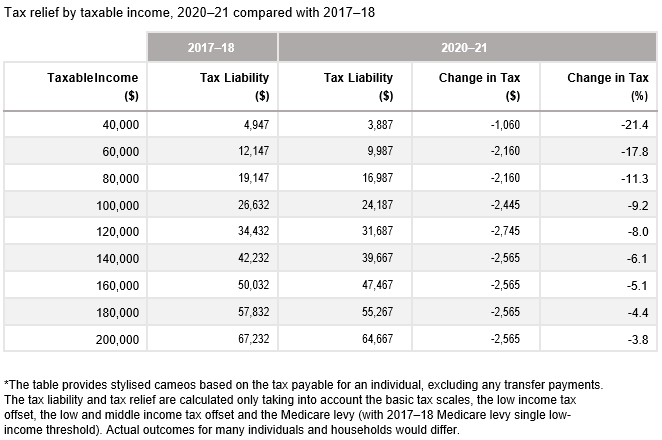

Mr Frydenberg said more than 7 million individuals are expected to receive tax relief of $2,000 or more for the 2020-21 income year compared with the 2017-18 tax settings. Low and middle income tax payers will receive relief of up to $2,745 for singles and $5,490 for dual income families.

These measures are estimated to cost $17.8bn over the forward estimates.

Rates and threshold tables

Tax rates and income thresholds

| Rate | 2019-20 | 2020-21 (new) | From 1.7.2024 (unchanged) |

| Nil | $0 - $18,200 | $0 - $18,200 | $0 - $18,200 |

| 19% | $18,201 - $37,000 | $18,201 - $45,000 | $18,201 - $45,000 |

| 30% | | | $45,001 - $200,000 |

| 32.5% | $37,001 - $90,000 | $45,001 - $120,000 | N/A |

| 37% | $90,001 - $180,000 | $120,001 - $180,000 | N/A |

| 45% | $180,001 + | $180,001 + | $200,001 + |

| Low and middle income tax offset (LMITO) | Up to $1,080 | Up to $1,080 | N/A |

| Low income tax offset (LITO) | Up to $445 | Up to $700 | Up to $700 |

The above table reflects the Government's proposal to bring forward the income tax rates and thresholds to 1 July 2020 (Stage 2), and retain Stage 3 to commence from 1 July 2024, as previously implemented by the Treasury Laws Amendment (Personal Income Tax Plan) Act 2018 and the Treasury Laws Amendment (Tax Relief So Working Australians Keep More Of Their Money) Act 2019.

The following table provided in a Budget Fact Sheet shows the tax relief by taxable income that would be provided in 2020-21 as compared to 2017-18:

Resident rates and thresholds - former 2020-21 (pre-2020 Budget)

The former 2020-21 tax rates and income thresholds for residents were:

Tax rates and income thresholds - former 2020-21 (pre-2020 Budget)

| Taxable income ($) | Tax payable ($) |

| 0 - 18,200 | Nil |

| 18,201 - 37,000 | Nil + 19% of excess over 18,200 |

| 37,001 - 90,000 | 3,572 + 32.5% of excess over 37,000 |

| 90,001 - 180,000 | 20,797 + 37% of excess over 90,000 |

| 180,001+ | 54,097 + 45% of excess over 180,000 |

Resident rates and thresholds - new for 2020-21 (proposed in 2020 Budget)

The tax rates and income thresholds below are the proposed new 2020-21 general rates for residents (as previously legislated to take effect from 2022-23):

Tax rates and income thresholds - new for 2020-21 (proposed in 2020 Budget)

| Taxable income ($) | Tax payable ($) |

| 0 - 18,200 | Nil |

| 18,201 - 45,000 | Nil + 19% of excess over 18,200 |

| 45,001 - 120,000 | 5,092 + 32.5% of excess over 45,000 |

| 120,001 - 180,000 | 29,467 + 37% of excess over 120,000 |

| 180,001+ | 51,667 + 45% of excess over 180,000 |

Stage 3: rates and thresholds from 2024-25 onwards

The Stage 3 tax changes remain unchanged and commence from 1 July 2024, as previously legislated. From 1 July 2024, the 32.5% marginal tax rate will be cut to 30% for one big tax bracket between $45,000 and $200,000. This will more closely align the middle tax bracket of the personal income tax system with corporate tax rates. The 37% tax bracket will be entirely abolished at this time under the Government's already legislated plan.

Therefore, from 1 July 2024, there will only be 3 personal income tax rates – 19%, 30% and 45%. From 1 July 2024, taxpayers earning between $45,000 and $200,000 will face a marginal tax rate of 30%. With these changes, around 94% of Australian taxpayers are projected to face a marginal tax rate of 30% or less.

Resident rates and thresholds - from 2024-25 onwards

The tax rates and income thresholds below are the 2024-25 general rates for residents (as already legislated):

Tax rates and income thresholds - from 2024-25 onwards

| Taxable income ($) | Tax payable ($) |

| 0 - 18,200 | Nil |

| 18,201 - 45,000 | Nil + 19% of excess over 18,200 |

| 45,001 - 200,000 | 5,092 + 30% of excess over 45,000 |

| 200,001+ | 51,592 + 45% of excess over 200,000 |

Foreign residents

For 2020-21, the tax rates for foreign residents will be:

- $0 - $120,000 - 32.5%;

- $120,001 - $180,000 - 37%;

- $180,001+ - 45%.

For 2024-25 and later income years, the tax rates for foreign residents are:

- $0 - 200,000 – 30%;

- $200,001+ - 45%.

Working holidaymakers

For 2020-21, the rates of tax for working holiday makers will be:

- $0 - $45,000 – 15%;

- $45,001 - $120,000 - 32.5%;

- $120,001 - $180,000 – 37%;

- $180,001+ - 45%.

For 2024-25 and later income years, the rates of tax for working holiday makers are:

- $0 - $45,000 – 15%;

- $45,001 - $200,000 – 30%;

- $200,001+ - 45%.

Source: Budget Paper No 2 [pp 18-19]; Treasurer's media release, 6 October 2020

|

[1070] Low income offsets - new LITO brought forward to 2020-21 and LMITO retained for 2020-21

| [1070] |

Low income offsets - new LITO brought forward to 2020-21 and LMITO retained for 2020-21

|

The Government announced in the Budget that the new low income tax offset (LITO) will be brought forward to start as from the 2020-21 income year. The new LITO was intended to replace the existing low income and low and middle income tax offsets as from 2022-23. Although the existing LITO is scrapped, the low and middle income offset (LMITO) will be retained for 2020-21.

Bringing forward the new LITO is a consequence of bringing forward to 2020-21 the tax cuts that were scheduled to start in 2022-23: see para [1069] of this Bulletin.

The maximum amount of the new LITO is $700. The LITO will be withdrawn at a rate of 5 cents per dollar between taxable incomes of $37,500 and $45,000 and then at a rate of 1.5 cents per dollar between taxable incomes of $45,000 and $66,667.

Low income tax offset (from 2020-21)

| Taxable income (TI) | Amount of offset |

| $0 – $37,500 | $700 |

| $37,501 - $45,000 | $700 - ([TI - $37,500] × 5%) |

| $45,001 - $66,667 | $325 - ([TI - $45,000] × 1.5%) |

| $66,668 + | Nil |

The amount of the LMITO is $255 for taxpayers with a taxable income of $37,000 or less. Between $37,000 and $48,000, the value of LMITO increases at a rate of 7.5 cents per dollar to the maximum amount of $1,080. Taxpayers with taxable incomes from $48,000 to $90,000 are eligible for the maximum LMITO of $1,080. From $90,001 to $126,000, LMITO phases out at a rate of 3 cents per dollar.

Low and middle income tax offset (2020-21)

| Taxable income (TI) | Amount of offset |

| $0 – $37,000 | $255 |

| $37,001 - $48,000 | $255 + ([TI – 37,000] × 7.5%) |

| $48,001 - $90,000 | $1,080 |

| $90,001 - 126,000 | $1,080 – ([TI – 90,000] × 3%) |

| $126,001 + | Nil |

Source: Budget Paper No 2 [p 18]

|

[1071] Targeted CGT exemption for "granny flat" arrangements

| [1071] |

Targeted CGT exemption for "granny flat" arrangements

|

The Budget confirms that the Government will put in place a "targeted" CGT exemption for granny flat arrangements.

Under the measure, CGT will not apply to the creation, variation or termination of a granny flat arrangement providing accommodation where there is a formal written agreement in place. The Budget states that it will apply to arrangements that provide accommodation for "older Australians or those with a disability". There are no further details as to what constitutes "older" or "disability".

The exemption will only apply to agreements that are entered into because of "family relationships or other personal ties" and will not apply to commercial rental arrangements.

Date of effect

It is intended that the measure commence from 1 July 2021 (ie next financial year), subject to the passage of necessary legislation. Specifically, the measure will have effect "from the first income year after the date of Royal Assent of the enabling legislation".

The measure was earlier announced by the Treasurer and Assistant Treasurer on 5 October 2020, the day the Government also publicly released the Board of Taxation's report on the taxation of granny flat arrangements (the report had been provided to the Government in November 2019). That report recommended the CGT exemption.

Source: Budget Paper No 2 [p 23]

|

[1072] New DGRs announced

|

A number of new deductible gift recipients (DGRs) were announced in the Budget. In all cases, a tax deduction is available for donations of $2 or more made on or after 1 July 2020. The new DGRs are:

- Royal Agricultural Society Foundation Limited;

- Judith Neilson Institute for Journalism and Ideas;

- The Andy Thomas Space Foundation;

- The Royal Humane Society of New South Wales;

- Youthsafe;

- Alliance for Journalists' Freedom;

- The Great Synagogue Foundation Trust Fund (until 30 June 2025).

The following organisations have received approval for their DGR status to be extended as follows:

- Sydney Chevra Kadisha - from 1 January 2021 to 30 June 2022;

- Centre for Entrepreneurial Research and Innovation Limited - from 31 December 2021 onwards.

The proposal to grant DGR status to China Matters Limited (from 1 July 2019 to 30 June 2024) will not proceed.

Source: Budget Paper No 2 [pp 21-22]

|

[1073] Tax exemptions for short-term IMF and World Bank missions

| [1073] |

Tax exemptions for short-term IMF and World Bank missions

|

The Government will clarify privileges and immunities, including income tax exemptions, available to Australian individuals performing short-term missions on behalf of the International Monetary Fund (IMF) and three institutions of the World Bank Group (WBG). The measure will apply retrospectively from 1 July 2017.

This measure will clarify that Australian short-term experts are entitled to an exemption from income tax for their relevant income from the organisations. This aligns Australia's domestic legislative framework with its international obligations and provides certainty for taxpayers. This outcome is consistent with Australia's longstanding support for and contributions to the IMF and WBG.

Thomson Reuters comment

It is possible that this measure was inspired by the decision in Hamilton and FCT [2020] AATA 1812 (4 June 2020), where the AAT decided that the taxpayer (a retired ATO officer) who had 2 short-term IMF appointments to foreign governments (Moldova and Armenia) did not hold an office with the IMF and therefore his IMF earnings were not tax exempt: see 2020 WTB 25 [667].

Source: Budget Paper No 2 [p 22]

|

BUSINESS TAXATION

[1074] Small business tax concessions extended to businesses in $10m-$50m range

| [1074] |

Small business tax concessions extended to businesses in $10m-$50m range

|

The Budget confirmed the Government's announcement on 2 October 2020 that a range of tax concessions currently available to small businesses (aggregated annual turnover under $10 million) will be made available to medium sized businesses, ie businesses with an aggregated annual turnover of $10 million or more but less than $50 million. The extension of these concessions to medium businesses will be delivered in 3 phases:

-

From 1 July 2020, eligible businesses will be able to immediately deduct certain start-up expenses and certain prepaid expenditure;

-

From 1 April 2021, eligible businesses will be exempt from the 47% FBT on car parking and multiple work-related portable electronic devices, such as phones or laptops, provided to employees. (Note that an FBT exemption for retraining redeployed employees will also apply from 2 October 2020: see para [1080] of this Bulletin);

-

From 1 July 2021:

- eligible businesses will be able to access the simplified trading stock rules, remit PAYG instalments based on GDP adjusted notional tax, and settle excise duty and excise-equivalent customs duty monthly on eligible goods;

- The time limit for the ATO to amend income tax assessments will be reduced from 4 to 2 years for eligible business for income years starting from 1 July 2021; and

- the Commissioner's power to create a simplified accounting method determination for GST purposes will be expanded to apply to businesses below the $50m aggregated annual turnover threshold.

The eligibility turnover thresholds for other small business tax concessions will remain at their current levels.

Source: Budget Paper No 2 [pp 16-17]; Treasurer's media release "Tax relief to back hard-working Australians and to create more jobs", 6 October 2020

|

[1075] Outright deduction of capital assets until 30 June 2022 for most businesses

| [1075] |

Outright deduction of capital assets until 30 June 2022 for most businesses

|

Businesses with aggregated annual turnover of less than $5 billion will be enable to deduct the full cost of eligible capital assets acquired from 7:30pm AEDT on 6 October 2020 (ie Budget night) and first used or installed by 30 June 2022.

Full expensing in the year of first use will apply to new depreciable assets and the cost of improvements to existing eligible assets. For small and medium sized businesses (ie those with aggregated annual turnover of less than $50 million), full expensing will also apply to second-hand assets.

Businesses with aggregated annual turnover between $50 million and $500 million can still deduct the full cost of eligible second-hand assets costing less than $150,000 that are purchased by 31 December 2020 under the current instant asset write-off rules (see para [1077] of this Bulletin). Businesses that hold assets eligible for the $150,000 instant asset write-off will have an extra 6 months, ie until 30 June 2021, to first use or install such assets.

Small businesses (with aggregated annual turnover of less than $10 million) can deduct the balance of their simplified depreciation pool at the end of the income year while full expensing applies. The provisions which prevent small businesses from re-entering the simplified depreciation regime for 5 years if they opt-out will continue to be suspended.

Source: Budget Paper No 2 [p 20]

|

[1076] Loss carry-back from 2019-20, 2020-21 and 2021-22 income years

| [1076] |

Loss carry-back from 2019-20, 2020-21 and 2021-22 income years

|

The Government will allow eligible companies to carry back tax losses from the 2019-20, 2020-21 or 2021-22 income years to offset previously taxed profits in 2018-19 or later income years.

Corporate tax entities with an aggregated turnover of less than $5 billion will be able to apply tax losses against taxed profits in a previous year, generating a refundable tax offset in the year in which the loss is made.

The tax refund will be limited by requiring that the amount carried back to not exceed the earlier taxed profits and to not generate a franking account deficit. The tax refund will be available on election by eligible businesses when they lodge their 2020-21 and 2021-22 tax returns.

Companies that do not elect to carry back losses under this measure can carry losses forward as normal.

Pre-existing loss carry-back rules

Loss carry-back was previously available to be claimed by eligible companies for the 2012-13 income year only under now repealed Div 160 of the ITAA 1997: see 2014 WTB 13 [252]. Given there is very little detail in the Budget papers, it is worth reminding ourselves of the former rules.

Division 160 allowed a corporate tax entity in a tax loss position to carry back up to $1m worth of its current year tax losses against tax assessed in either or both of the previous 2 income years. An unutilised tax loss from the previous year could be carried back one year.

A corporate tax entity received the benefit of the loss carry-back as a refundable tax offset, which formed part of the entity's tax assessment for the current year. Any tax loss not carried back could be carried forward for use in future income years.

Loss carry-back was optional, requiring a choice to be made when the entity lodged its tax return for the current year.

An entity had to satisfy a number of conditions in order to carry back a tax loss. In particular, the availability of the loss carry-back tax offset was restricted in the following respects:

- loss carry-back was only available to companies and other corporate tax entities;

- only tax losses (ie revenue losses) could be carried back. The following were treated as excluded losses for Div 160 purposes: losses transferred under Div 170 (between companies in the same foreign banking group) or Subdiv 707-A (to a head company by a joining entity) and that part of a tax loss which is deemed to exist when a corporate tax entity has excess franking offsets for an income year;

- the carry back period was limited to 2 income years, and the entity had to have an income tax liability in at least one of those years; and

- the entity must have had no outstanding tax returns.

There were also rules which limited the maximum loss carry-back tax offset for any claim year (with the amount of the offset capped at the lesser of the tax payable on $1 million taxable income and the entity's franking account balance). The carry back loss was reduced by any net exempt income of the year the loss was carried back to.

Division 160 included a specific integrity rule to prevent an otherwise eligible entity from claiming the loss carry-back tax offset if there was a scheme to dispose of membership interests and a purpose of the scheme was to obtain a financial benefit calculated by reference to the offset.

Source: Budget Paper No 2 [p 21]

|

[1077] Instant asset write-off: minor change only, but limited relevance

| [1077] |

Instant asset write-off: minor change only, but limited relevance

|

Given the largesse of the new outright deduction for capital assets until 30 June 2022 (see para [1075] of this Bulletin), the instant asset write-off rules have become temporarily irrelevant for most taxpayers (ie those with aggregated annual turnover of less than $5 billion).

Accordingly, there were no changes to the rules, other than a slight tweaking for costs relating to second-hand goods acquired by large businesses (ie those with annual aggregated turnover between $50 million and $500 million).

To contextualise this, the new outright deduction rules do not apply to second-hand goods, other than those acquired by small and medium sized businesses (ie with aggregated annual turnover of less than $50 million) – who can fully expense costs associated with second-hand goods.

For this reason, businesses with aggregated annual turnover between $50 million and $500 million can still deduct the full cost of eligible second-hand assets costing less than $150,000 that are purchased by 31 December 2020 under the instant asset write-off provisions. The tweak is this – businesses that hold assets eligible for the $150,000 instant asset write-off will have an extra 6 months, until 30 June 2021, to first use or install those assets.

The tables below set out the rates and thresholds as they currently operate – but should be read in the context that the instant asset write-off rules are effectively irrelevant for most eligible assets purchased after 6 October 2020 until 30 June 2022. The rules set out 3 taxpayer categories.

Small business entities

Those taxpayers with aggregated turnover of less than $10 million and who satisfy the other tests in Subdiv 328-C of ITAA 1997 can qualify as small business entities for the purpose of the instant asset write-off rules. A depreciating asset is a low cost asset if its cost as at the end of the income year in which the taxpayer starts to use it, or installs it ready for use, for a taxable purpose is less than the relevant threshold: s 328-180. These are set out in the table.

Small business entities (<$10m)

| Asset first acquired and first used/installed ready for use, or when amount included in second element of cost | Threshold ($) |

| 3 April 2019 to 11 March 2020 | 30,000 |

| 12 March 2020 to 31 December 2020 | 150,000 |

The threshold is due to revert back to $1,000 on 1 January 2021 (note, though, it has not been $1,000 since 2015).

Medium sized business entities

The next category of taxpayer for instant asset write off purposes is medium sized business entities. This applies to those with an aggregated annual turnover of $10 million or more, but less $50 million.

Medium business entities ($10m<$50m)

| Asset first acquired and first used/installed ready for use, or when amount included in second element of cost | Threshold ($) |

| 3 April 2019 to 11 March 2020 | 30,000 |

| 12 March 2020 to 31 December 2020 | 150,000 |

There was an increase in the threshold from $30,000 to $150,000 when the COVID measures started: see 2020 WTB 12 [263]. The instant asset write-off under s 40-82 will cease to be available to medium businesses from 1 January 2021: see 2020 WTB 23 [594].

Large business entities

The third category of taxpayer for instant asset write off purposes is large business entities. This applies to those with an aggregated annual turnover of $10 million or more, but less $500 million.

The write-off has only been available to such entities while the COVID measures are in place: see 2020 WTB 12 [263].

Large business entities ($50m<$500m)

| Asset first acquired and first used/installed ready for use, or when amount included in second element of cost | Threshold ($) |

| 12 March 2020 to 31 December 2020 | 150,000 |

As noted above, taxpayers in this category have until 30 June 2021 to first use or install assets (rather than 31 December 2020). It otherwise ceases on 31 December 2020: see 2020 WTB 23 [594].

Source: Budget Paper No 2 [p 20]

|

[1078] Despite Budget outright deduction changes, depreciation rules still relevant

| [1078] |

Despite Budget outright deduction changes, depreciation rules still relevant

|

There were no changes to the capital allowance rules in the 2020-21 Federal Budget. This means that the depreciation rules as currently legislated will not change.

This is not a surprise, given the ability of pretty much all businesses to claim an outright deduction for new asset purchases from 7 October 2020 to 30 June 2022: see para [1075] of this Bulletin.

Note, though, that as part of its response to the COVID-19 pandemic, the Government had earlier enacted to allow businesses with aggregated turnovers of less than $500 million in an income year to deduct capital allowances for depreciating assets at an accelerated rate. This is a temporary measure – it is due to finish on 30 June 2021: see 2020 WTB 12 [264].

It is worth revisiting these rules because there may be acquisitions that may fall outside the outright deduction rules but still qualify for depreciation (eg certain second-hand goods). The rules still have an ongoing relevance for acquisitions made on or before 6 October 2020.

Due to the temporary nature of the concession, the measures were enacted in the Income Tax (Transitional Provisions) Act 1997 – so the section references below are to that Act.

To be eligible for the accelerated depreciation, the depreciating asset must be (s 40-125 TPA):

- new and not previously held by another entity (other than as trading stock or for the purposes of reasonable testing or trialling) – this excludes most second-hand assets;

- first held on or after 12 March 2020 (ie a post-11 March 2020 asset); and

- first used or first installed ready for use for a taxable purpose on or after 12 March 2020 and before 1 July 2021.

A depreciating asset will not qualify for the accelerated depreciation if (s 40-120(3) TPA):

- the decline in value of the asset has already been deducted under the instant asset write-off rules;

- the decline in value of the asset is worked out using low-value and software development pools; or

- the decline in value of the asset is worked using Subdiv 40-F of the ITAA 1997, ie certain primary production depreciating assets.

In terms of working out the accelerated depreciation, different rules apply depending on whether or not an entity is using the simplified rules for capital allowances for small businesses.

An entity with aggregated turnover of less than $500m in the income year that does not use the simplified depreciation rules may deduct an amount at an accelerated rate for qualifying assets. The amount the entity can deduct in the income year the asset is first used or installed ready for use for a taxable purpose is:

- 50% of the cost (or adjustable value where applicable) of the depreciating asset; and

- the amount of the usual depreciation deduction that would otherwise apply but calculated after first offsetting a decline in value of 50%.

A small business entity (ie, an entity with an aggregated turnover less than $10 million in the income year) that uses the simplified depreciation rules may deduct an amount equal to 57.5% (rather than 15%) of the taxable purpose proportion of the adjusted value of a qualifying depreciating asset added to the general small business pool in an income year.

|

[1079] Corporate residency test to be clarified

| [1079] |

Corporate residency test to be clarified

|

The Government will make technical amendments to clarify the corporate residency test.

The law will be amended to provide that a company that is incorporated offshore will be treated as an Australian tax resident if it has a "significant economic connection to Australia". This test will be satisfied where both the company's core commercial activities are undertaken in Australia and its central management and control is in Australia.

The Government said that the corporate residency rules are fundamental to determining a company's Australian income tax liability. The ATO's interpretation following the High Court's decision in Bywater Investments Ltd v FCT (2016) 104 ATR 82 departed from the long-held position on the definition of a corporate resident. The Government requested the Board of Taxation to review the definition in 2019-20.

This measure is consistent with the Board's key recommendation in its 2020 report: Review of Corporate Tax Residency (see 2020 WTB 34 [898]) and will mean the treatment of foreign incorporated companies will reflect the position prior to the High Court's decision in Bywater.

Date of application

The measure will have effect from the first income year after the date of the enabling legislation receives assent, but taxpayers will have the option of applying the new law from 15 March 2017 (the date on which the ATO withdrew Ruling TR 2004/15: residence of companies not incorporated in Australia — carrying on a business in Australia and central management and control).

Source: Budget Paper No 2 [pp 13-14]

|

[1080] FBT exemption for retraining redeployed employees

| [1080] |

FBT exemption for retraining redeployed employees

|

The Budget confirmed the Government's announcement on 2 October 2020 that it will provide an FBT exemption for employer-provided retraining and reskilling benefits provided to redundant, or soon to be redundant, employees where the benefits are not related to their current employment.

Currently, FBT is payable if an employer provides training to its employees that is not sufficiently connected to their current employment. For example, a business that retrains their sales assistant in web design to redeploy them to an online marketing role in the business can be liable for FBT. By removing FBT, the Treasurer said employers will be encouraged to retain redundant employees to prepare them for their next career.

The FBT exemption will not extend to retraining acquired by way of a salary packaging arrangement or training provided through Commonwealth supported places at universities, which already receive a benefit, or extend to repayments towards Commonwealth student loans.

In addition, the Government said it will consult on allowing an individual to deduct education and training expenses they incur themselves where the expense is not related to their current employment. In this respect, the Government acknowledged that the current rules, which limit self-education deductions to training related to current employment, may act as a disincentive to individuals to retrain and reskill to support their future employment and career.

Date of effect

The FBT exemption will apply from 2 October 2020 (ie the date of announcement).

Note that an FBT exemption from 1 April 2021 will also apply for eligible businesses on car parking and multiple work-related portable electronic devices, such as phones or laptops: see para [1074] of this Bulletin.

Source: Budget Paper No 2 [p 15]

An example from EY

The proposed FBT exemption for retraining employees follows a Senate Committee recommendation calling for eligible outplacement training to be included under the FBT exemption. The interim report by the Senate Select Committee on Financial Technology and Regulatory Technology (see 2020 WTB 35 [929]) recently called on the Government to explore the inclusion of eligible outplacement training under the FBT exemption for eligible start-ups.

A submission by EY to the Senate Committee on 9 January 2020 perhaps best sums up the issue as follows.

Consider an employer who, as a result of technology advancements, might make an employee redundant but wishes to invest in that employee's future employment or business prospects by retraining activities as well as outplacement advice. The ATO view is that outplacement assistance services are FBT exempt, but any actual attempt to retrain or upskill the employee would subject to FBT under the law.

EY notes that this FBT cost makes these activities economically prohibitive as it effectively doubles the cost for employers wanting to arrange such retraining programs. Accordingly, EY called for the FBT law to be amended to exempt from FBT, costs and activities undertaken by employers to attempt to re-skill and retrain terminating employees.

EY set out the following example of the prohibitive costs based on these assumptions - External retraining cost per employee (including GST) = $1,500; number of terminating employees = 30.

FBT and retraining

| Amount ($) | With FBT | FBT exempt |

| Retraining cost before tax ($1,500 x 30) | 45,000 | 45,000 |

| FBT payable (Type 1 gross-up, for employer paying GST) | 43,996 | - |

| Total cost (before tax) | 88,996 | 45,000 |

| Corporate tax rate | 30% | 30% |

| Total cost (after tax) | 62,297 | 31,500 |

|

[1081] FBT record-keeping - reducing compliance burden

| [1081] |

FBT record-keeping - reducing compliance burden

|

To reduce the FBT compliance burden, the Government will provide the ATO with the power to allow employers to rely on existing corporate records, rather than employee declarations and other prescribed records, to finalise their FBT returns.

Currently, the FBT legislation prescribes the form that certain records must take and forces employers, and in some cases employees, to create additional records in order to comply with FBT obligations.

This measure will apply from the start of the first FBT year (1 April) after the date the enabling legislation receives assent.

Source: Budget Paper No 2 [pp 15-16]

|

[1082] R&D Tax Incentive changes announced and start date deferred

| [1082] |

R&D Tax Incentive changes announced and start date deferred

|

The Government has announced a number of changes to the R&D tax offset measures contained in the Treasury Laws Amendment (Research and Development Tax Incentive) Bill 2019 (see 2019 WTB [1587]) and deferred the start date of those measures to income years starting on or after 1 July 2021.

In broad terms, the Bill proposes:

- increasing the R&D expenditure threshold from $100m to $150m and making the threshold a permanent feature of the law (ie removing its sunsetting in 2024);

- linking the R&D tax offset for refundable R&D tax offset claimants to claimants' corporate tax rates plus a 13.5% premium;

- capping the refundability of the R&D tax offset at $4m per annum; and

- increasing the targeting of the incentive to larger R&D entities with high levels of R&D intensity.

The Bill was passed by the House of Reps on 10 February 2020 and referred to the Senate Economics Legislation Committee for a report by 12 October 2020. It is unclear if these Budget changes will be made by amendments to the much delayed Bill or in a separate Bill.

The changes to the Bill measures announced in the Budget are detailed below.

Refundable tax offset increased

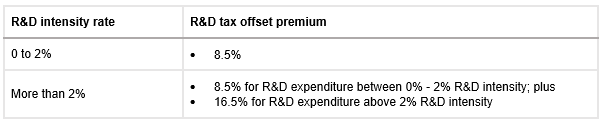

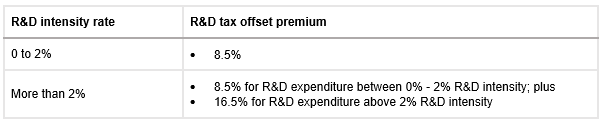

For companies with an aggregated annual turnover of less than $20m, the refundable R&D tax offset will be set at 18.5% above the claimant's company tax rate (compared to 13.5% in the Bill).

Annual cap on cash refunds abandoned

The Government will not proceed with the measure proposed in the Bill to impose an annual cap on R&D tax offset refunds of $4m (with any remaining offset amounts being treated as non-refundable carry forward tax offsets).

The Bill provided an exclusion from the annual cap for eligible expenditure on clinical trials registered as R&D activities. This carve out acknowledged opportunities for growth in the medical technology, biotechnology and pharmaceutical sectors. The Budget Papers do not provide any guidance as to whether clinical trials will be given special recognition by other means under the R&D incentive rules.

R&D intensity bands reduced

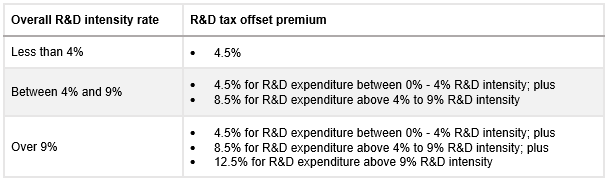

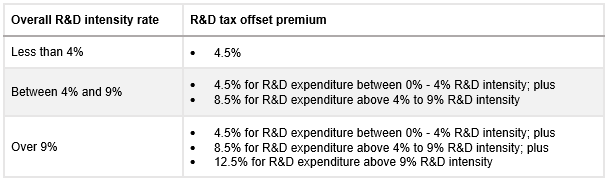

The Bill makes provision for R&D premium offsets (above the company's tax rate) tied to a company's incremental R&D intensity (notional deductions/total expenses) as reflected in the table below.

For companies with aggregated annual turnover of $20m or more, the Government will reduce the number of R&D intensity tiers from 3 to 2 as per the following table.

Source: Budget Paper No 2 [p 19]

|

[1083] State COVID-19 business support grants - NANE income

| [1083] |

State COVID-19 business support grants - NANE income

|

The Federal Government announced that the Victorian government's business support grants for small and medium business non-assessable, non-exempt (NANE) income for tax purposes. The Victorian Government announced the grants on 13 September: see 2020 WTB 37 [1007].

The Federal Government will extend this arrangement to all States and Territories on an application basis. Eligibility would be restricted to future grants program announcements for small and medium businesses facing similar circumstances to Victorian businesses.

A new power will be introduced in the income tax laws to make regulations to ensure that specified state and territory COVID-19 business support grant payments are NANE income.

Eligibility for this treatment will be limited to grants announced on or after 13 September 2020 and for payments made between 13 September 2020 and 30 June 2021.

Source: Budget Paper No 2 [p 14]

|

[1084] JobMaker Hiring Credit

|

The Budget announced that the Government will provide $4 billion over 3 years from 2020-21 to accelerate employment growth by supporting organisations to take on additional employees through a hiring credit. The JobMaker Hiring Credit will be available to eligible employers over 12 months from 7 October 2020 for each additional new job they create for an eligible employee.

Eligible employers who can demonstrate that the new employee will increase overall employee headcount and payroll will receive $200 per week if they hire an eligible employee aged 16 to 29 years or $100 per week if they hire an eligible employee aged 30 to 35 years. The JobMaker Hiring Credit will be available for up to 12 months from the date of employment of the eligible employee with a maximum amount of $10,400 per additional new position created.

To be eligible, the employee will need to have worked for a minimum of 20 hours per week, averaged over a quarter, and received the JobSeeker Payment, Youth Allowance (other) or Parenting Payment for at least one month out of the three months prior to when they are hired.

New jobs created until 6 October 2021 will attract the JobMaker Hiring Credit for up to 12 months from the date the new position is created.

To be eligible, the employee must have received the JobSeeker Payment, Youth Allowance (Other), or Parenting Payment for at least one of the previous 3 months at the time of hiring.

The JobMaker Hiring Credit will be claimed quarterly in arrears by the employer from the ATO from 1 February 2021. Employers will need to report quarterly that they meet the eligibility criteria.

To attract the JobMaker Hiring Credit, the employee must be in an additional job created from 7 October 2020. To demonstrate that the job is additional, specific criteria must be met. The "additionality criteria" require that there is an increase in:

- the business' total employee headcount (minimum of one additional employee) from the reference date of 30 September 2020; and

- the payroll of the business for the reporting period, as compared to the 3 months to 30 September 2020.

Employer eligibility

Employers are eligible to receive the JobMaker Hiring Credit if they:

- have an ABN;

- are up to date with tax lodgment obligations;

- are registered for PAYG withholding;

- are reporting through Single Touch Payroll (STP);

- meet the "additionality criteria";

- are claiming in respect of an eligible employee; and

- have kept adequate records of the paid hours worked by the employee they are claiming the hiring credit in respect of.

Newly established businesses

Newly established businesses and businesses with no employees at the reference date of 30 September 2020 are able to claim the JobMaker Hiring Credit where they meet the criteria. The minimum baseline headcount is one, so employers who had no employees at 30 September 2020 or who were created after this reference date will not be eligible for the first employee hired, but will be eligible for the second and subsequent eligible hires.

A JobMaker Hiring Credit Fact Sheet contains further details and examples.

Source: Budget Paper No 2 [p 162]; Treasurer's press release, 6 October 2020

|

[1085] Supporting small business and responsible lending

| [1085] |

Supporting small business and responsible lending

|

The Budget confirmed that the Government will implement reforms to support consumers and businesses affected by COVID-19 to facilitate Australia's economic recovery. The reforms are designed to reduce regulatory burden to ensure a timely flow of credit and resolution for distressed business. These include:

- introducing a new process to enable eligible incorporated small businesses in financial distress to restructure their own affairs;

- simplifying the liquidation process for eligible incorporated small businesses;

- support for the insolvency sector;

- introducing a standard licensing regime for debt management firms who represent consumers in dispute resolution processes with credit providers;

- removing duplication between the responsible lending obligations contained in the National Consumer Credit Protection Act 2009 and the Australian Prudential Regulation Authority (APRA) standards and guidance for authorised deposit-taking institutions (ADIs) and establishing a similar new credit framework for non-ADIs;

- enhancing the regulation of Small Amount Credit Contracts and Consumer Leases to ensure that the most vulnerable consumers are protected.

Source: Budget Paper No 2 [p 163]

|

[1086] Film Producer Offset changes confirmed

| [1086] |

Film Producer Offset changes confirmed

|

The Budget confirmed changes to the Australian Screen Production Incentive Program from 1 July 2021, announced on 30 September 2020 by the Minister for Communications, including harmonising the Producer Offset rebate rate to 30% for eligible film and television content and complementary amendments to the 3 film tax offsets.

Source: Budget Paper No 2 [p 141]

|

[1087] List of information exchange jurisdictions updated

| [1087] |

List of information exchange jurisdictions updated

|

The Government will update the list of jurisdictions that are "information exchange countries" for Australian tax purposes.

Residents of listed jurisdictions are eligible to access the reduced MIT withholding tax rate of 15% on fund payments not attributable to non-concessional MIT income.

Added jurisdictions: the Dominican Republic, Ecuador, El Salvador, Hong Kong, Jamaica, Kuwait, Morocco, North Macedonia and Serbia.

Kenya will be removed because, as of January 2020, when the annual assessment was undertaken to determine the updates to be made to the list, it had not yet entered into an information sharing agreement with Australia.

The updated list will be effective from 1 July 2021.

Source: Budget Paper No 2 [p 17]

|

SUPERANNUATION

[1088] Super reforms: accounts to be stapled to members; best financial interests duty; other

| [1088] |

Super reforms: accounts to be stapled to members; best financial interests duty; other

|

The Government will provide $159.6m to implement reforms to superannuation to improve outcomes for super fund members.

The Your Future, Your Super package, which will seek to reduce the number of duplicate accounts held by employees as a result of changes in employment and prevent new members joining underperforming funds, includes:

-

YourSuper portal - the ATO will develop systems so that new employees will be able to select a superannuation product from a table of MySuper products through the YourSuper portal;

-

stapled accounts - an existing superannuation account will be "stapled" to a member to avoid the creation of a new account when that person changes their employment. Future enhancements will enable payroll software developers to build systems to simplify the process of selecting a superannuation product for both employees and employers through automated provision of information to employers;

-

MySuper benchmarking - from July 2021, APRA will conduct benchmarking tests on the net investment performance of MySuper products, with products that have underperformed over two consecutive annual tests prohibited from receiving new members until a further annual test that shows they are no longer underperforming. Non-MySuper accumulation products where the decisions of the trustee determine member outcomes will be added from 1 July 2022. The funding for this initiative will be met through an increase in levies on regulated financial institutions; and

-

super trustees - best financial interests duty - to improve transparency and accountability of super funds, the Government will legislate to compel super trustees to also act in the best "financial" interests of their members: see below.

The Treasurer said this package of reforms will help improve the $3 trillion superannuation system, and save members $17.9 billion over 10 years, by:

-

having an individual's super follow them - preventing the creation of unintended multiple superannuation accounts when employees change jobs. Instead, an individual's super will follow them so that a new employer will pay their super contributions into the individual's existing account;

-

making it easier to choose a better fund - members will have access to a new interactive online YourSuper comparison tool which will encourage funds to compete harder for members' savings. It will show a member's current super accounts and prompt them to consider consolidating accounts if they have more than one;

-

holding funds to account for underperformance - to protect members from poor outcomes and encourage funds to lower costs, the Government will require superannuation products to meet an annual objective performance test. Those that fail will be required to inform members by 1 October 2021. Persistently underperforming products will be prevented from taking on new members; and

-

transparency and accountability - the Government will increase trustee accountability by strengthening their obligations to ensure trustees only act in the best financial interests of members. The Government will also require super funds to provide better information regarding how they manage and spend members' money in advance of Annual Members' Meetings.

Source: Budget Paper No 2 [pp 164-165]; Treasurer's media release, 6 October 2020; Treasury fact sheet, Your Future, Your Super.

Stapled accounts - how they will work

The first phase of the reforms is proposed to commence on 1 July 2021. Employers will no longer automatically create a new superannuation account in their chosen default fund for new employees when they do not decide on a super fund. Instead, employers will obtain information about the employee's existing super fund from the ATO, if it is not provided by the employee.

The employer will do this by logging onto ATO online services and entering the employee's details. Once an account has been selected, the employer will pay super contributions into the employee's account.

The second phase of the reforms will see the ATO provide a new service for employers. As of 1 July 2022, the ATO will enable digital software providers to give employers the option to automate the communications between the employer's payroll system and the ATO system. Once this new service is adopted, it will remove the need for the employer to manually enter into their payroll system their employees' superannuation fund details, reducing business administration costs.

Under both phases, if an employee does not have an existing super account (eg is new to the workforce) and does not make a decision regarding a fund, the employer will pay the employee's super into their nominated default super fund.

Super trustees - best financial interests duty

The Government will legislate to compel super trustees to act in the best financial interests of their members. Consistent with the recommendation of the Productivity Commission to clarify what it means for a trustee to act in members' best interests, the Government said it will put beyond doubt that trustees must act in the best financial interests of members. The measure seeks to remove ambiguity on how super trustees should be spending members' money.

It will also give effect to the statement in the Explanatory Memorandum to the Superannuation Legislation Amendment (MySuper Core Provisions) Act 2012 that "RSE [Registrable Superannuation Entity] licensees will have a heightened obligation to act in the best financial interests of members that accept the default option".

In addition to strengthening the duty owed by trustees, the onus on demonstrating compliance with the new duty will be reversed so that trustees must establish that there was a reasonable basis to support their actions being consistent with members' best financial interests.

To ensure that the best financial interests duty is complied with by super funds, these changes will be accompanied by anti-avoidance measures, to ensure payments from the super fund to a third party (including an interposed or a related entity) do not undermine the intent of the changes.

No materiality threshold will apply to the new duty.

The penalty provisions introduced by the Government under the Treasury Laws Amendment (Improving Accountability and Member Outcomes in Superannuation Measures No 1) Act 2019 will apply for breaches of the new duty for both the trustee and individual directors.

Date of effect

All measures will commence by 1 July 2021.

Next steps - roadmap to reform

Your Future, Your Super

| Policy | Start date | Implementation |

| Your super follows you | 1 July 2021 | No unintended multiple accounts will be created after 1 July 2021 |

| Empowering members | 1 July 2021 | YourSuper comparison tool will be available no later than 1 July 2021 |

| Holding funds to account for underperformance | 1 July 2021 | APRA will complete first benchmarking tests for MySuper products in September 2021, with trustees of underperforming products to notify members by 1 October 2021 |

| Best financial interests duty | 1 July 2021 | Obligations will apply to trustee decisions taken on or after 1 July 2021 |

| Annual Members' Meetings | 1 July 2021 | Trustees will be required to send information for Annual Members' Meetings from 1 July 2021 |

Background

These reforms appear to be aimed at the recommendations in the Productivity Commission's 2019 report into the superannuation system to address multiple super accounts and default funds that underperform: see 2019 WTB 2 [42].

The introduction of stapled accounts will implement Recommendation 3.5 of the Banking Royal Commission (see 2019 WTB 8 [155]) and Recommendation 1 of the Productivity Commission report into the super system. The proposed best financial interests duty for super trustees will give effect to recommendation 22 of the Productivity Commission report.

See also APRA Prudential Standard SPS 515 (Strategic Planning and Member Outcomes) for how superannuation licensees must make a member outcomes assessment to comply with the Treasury Laws Amendment (Improving Accountability and Member Outcomes in Superannuation Measures No 1) Act 2019.

|

[1089] Super Guarantee: no change to rate increase set for July 2021

| [1089] |

Super Guarantee: no change to rate increase set for July 2021

|

The Budget did not announce any change to the timing of the next Super Guarantee (SG) rate increase. The SG rate is currently legislated to increase from 9.5% to 10% from 1 July 2021, and by 0.5% per year from 1 July 2022 until it reaches 12% from 1 July 2025.

Prior to the Budget, there was speculation as to whether the Government may consider delaying this legislated SG rate increase in the interest of promoting spending and jobs, at the expense of workers' retirement savings. ASFA modelling has previously suggested that an average income earner aged 30 today, and on a $70,000 salary would have $71,600 less when retiring at 67 if the SG stays at 9.5%.

While the Budget did not announce any change to the start date for the SG rate increase, the Government probably does not need to decide this policy issue until next year's Federal Budget in May 2021, ahead of the 1 July 2021 legislated change date for the SG rate.

|

OTHER MEASURES

[1090] Wage subsidy for new apprentices

| [1090] |

Wage subsidy for new apprentices

|

The Government will provide a capped 50% wage subsidy to businesses who take on a new Australian apprentice from 5 October 2020 to 30 September 2021.

It will be available to employers of any size or industry, Australia-wide – regardless of geographic location or occupation. There are 2 important caps:

- it is limited to 100,000 new apprentices or trainees in total; and

- the 50% subsidy will be limited to $7,000 per quarter (ie $28,000 per annum).

More information can be found on the Department of Education, Skills and Employment website. It states that the payment will be paid in respect of commencing or recommencing apprentice's – ie, it will be possible to re-employ former apprentices whose employment had been terminated.

Date of effect

The scheme will run from 5 October 2020 to 30 September 2021. The measure was earlier announced by the Prime Minister on 5 October 2020.

The Department of Education, Skills and Employment states that the start date for claims is 1 January 2021, ie that payments will be made in arrears. It also provides details as to how to register.

Source: Budget Paper No 2 [p 77]

|

[1091] First Home Loan Deposit Scheme: additional 10,000 places

| [1091] |

First Home Loan Deposit Scheme: additional 10,000 places

|

The Government will allocate an additional 10,000 places for first home buyers under the existing First Home Loan Deposit Scheme.

Under the existing Scheme, eligible first home buyers can obtain a loan to build a new home or purchase a newly built home with a deposit of as little as 5%. The Scheme provides a Government-backed guarantee equals to the difference between the deposit (of at least 5%) and 20% of the purchase price. Applications can be made as part of the standard home loan application process through participating lenders. The Scheme has already helped almost 20,000 first home buyers.

The Treasurer said eligible first home buyers will also be able to take advantage of the Federal Government's First Home Super Saver Scheme and HomeBuilder (see 2020 WTB 22 [565]). First home buyers may also be eligible for State and Territory grants and concessions.

Date of effect

The additional 10,000 places under the scheme will be provided from 6 October 2020. The additional guarantees will be available until 30 June 2021.

Source: Budget Paper No 2 [pp 161]; Treasurer's media release, 3 October 2020

|

[1092] Additional funding for ATO to fight serious crime

| [1092] |

Additional funding for ATO to fight serious crime

|

The Government will provide $15.1 million to the ATO to target serious and organised crime in the tax and superannuation systems. This extends the 2017-18 Budget measure Additional funding for addressing serious and organised crime in the tax system by a further two years to 30 June 2023.

This measure is estimated to increase the underlying cash balance by $18.9 million including an increase in GST payments to the States and Territories of $3.8 million over the forward estimates period. In fiscal balance terms, this measure is estimated to have a gain to the budget of $136.8 million over the forward estimates period.

Source: Budget Paper No 2 [p 13]

|

[1093] Additional funds for foreign investment application processing

| [1093] |

Additional funds for foreign investment application processing

|

The Government will provide $86.3 million over four years to implement a new ICT platform to support more effective and efficient foreign investment application processing and compliance activities across Government and a new consolidated Register of Foreign Ownership of Australian Assets. This is in addition to net funding of $54.1 million over 4 years announced in the July 2020 Economic and Fiscal Update, for reforming Australia's foreign investment framework.

The Government will also simplify the foreign investment fee framework and adjust fees from 1 January 2021. The revised fees will ensure that foreign investors, not Australian taxpayers, bear the costs of administering the foreign investment system.

This measure is estimated to increase the underlying cash balance by $54.7 million over the forward estimates period.

Source: Budget Paper No 2 [p 23]

|

[1094] Business Innovation and Investment Program to be streamlined

| [1094] |

Business Innovation and Investment Program to be streamlined

|

From 1 July 2021, the Government will streamline and improve the operation of the Business Innovation and Investment Program (BIIP). The Government will introduce changes to improve the quality of investments and applicants. Visa application charges for BIIP visas will also be increased by an additional 11.3% (above regular CPI indexation) on 1 July 2021.

The Government said that these changes will sharpen the focus of the BIIP program on higher value investors, business owners and entrepreneurs and improve the economic outcomes of the BIIP.

Source: Budget Paper No 2 [p 10]

|

[1095] Customs duty: free rate for COVID-19 related medical products extended

| [1095] |

Customs duty: free rate for COVID-19 related medical products extended

|

The Government has extended the free rate of customs duty from 1 August 2020 to 31 December 2020 for certain hygiene or medical products imported to treat, diagnose or prevent the spread of COVID-19. Affected product types include face masks, gloves, disinfectant preparations (excluding hand sanitiser), soaps, COVID-19 test kits and reagents, and viral transport media.

Source: Budget Paper No 2 [pp 8, 178]

|

SOCIAL SECURITY MEASURES

[1096] $250 cash payments for income support recipients

| [1096] |

$250 cash payments for income support recipients

|

The Government will pay two $250 economic support payments for eligible income support recipients and concession card holders. The payments will be made from November 2020 and early 2021 to eligible income support recipients and concession card holders, including:

- Age Pension;

- Disability Support Pension;

- Carer Payment;

- Family Tax Benefit, including Double Orphan Pension (not in receipt of a primary income support payment);

- Carer Allowance (not in receipt of a primary income support payment);

- Pensioner Concession Card (PCC) holders (not in receipt of a primary income support payment);

- Commonwealth Seniors Health Card holders; and

- eligible Veterans' Affairs payment recipients and concession card holders.

The $250 cash payments are tax exempt and will not count as income support for social security purposes.

These cash payments follow the two $750 stimulus payments that were paid in April and July 2020 for social security and veteran income support recipients and concession card holders.

Source: Budget Paper No 2 [p 151]; Treasurer's media release, 6 October 2020

|

[1097] Deeming rates – no change

| [1097] |

Deeming rates – no change

|

In what may come as a surprise (and disappointment) to many retirees, the Budget was silent on further reductions to the deeming rates.

Under the current deeming rules:

-

Singles: The first $53,000 of financial assets has the deemed rate of 0.25% applied. Anything over $53,000 is deemed to earn 2.25%.

-

Couples: The first $88,000 of combined financial assets has the deemed rate of 0.25% applied. Anything over $88,000 is deemed to earn 2.25%.

-

Member of a couple and neither of you get a pension: The first $44,000 of each of your own and your share of joint financial assets has a deemed income of 0.25% per year. Anything over $44,000 is deemed to earn 2.25%.

With the Reserve Bank decision on 6 October 2020 holding the official cash rate target at 0.25% (it has now been at that rate for 7 months since 20 March 2020), some further revision of the deeming rates might have been expected. This did not happen.

|

[1098] Youth Allowance and ABSTUDY eligibility: incentives re seasonal work

| [1098] |

Youth Allowance and ABSTUDY eligibility: incentives re seasonal work

|

The Budget announced that the Government will provide $16.3 million over 3 years from 2020-21 to incentivise seasonal participation in the agricultural industry, by creating a temporary pathway for young people who are seeking to qualify as independent for the purposes of assessing Youth Allowance (student) and ABSTUDY payment eligibility.

From 1 December 2020, those who earn at least $15,000 in the agricultural industry between 30 November 2020 and 31 December 2021 would be automatically assessed as meeting independence requirements, provided their parents meet current parenting income testing requirements.

Source: Budget Paper No 2 [p 155]

|

[1099] Youth Allowance and ABSTUDY independence test

| [1099] |

Youth Allowance and ABSTUDY independence test

|

The Government will provide $25 million over 4 years from 2020-21 to temporarily revise the independence test for those applying for Youth Allowance and ABSTUDY from 1 January 2021. Under the exemption, the 6-month period between 25 March 2020 and 24 September 2020 will automatically be recognised as contributing to an applicant's independence test, regardless of whether they meet employment requirements.

Source: Budget Paper No 2 [p 152]

|

[1100] Cashless Debit Card - ongoing funding

| [1100] |

Cashless Debit Card - ongoing funding

|

The Government will provide funding to continue the Cashless Debit Card (CDC) in existing locations on an ongoing basis as well as provide support to transition participants from Income Management to CDC in the Northern Territory and Cape York region. This funding will also provide for a trial of emerging payment acceptance technologies.

The funding for this measure is not for publication (nfp) as negotiations with potential commercial providers are yet to be finalised.

Source: Budget Paper No 2 [p 151]

|

[1101] Paid Parental Leave – alternative work test

| [1101] |

Paid Parental Leave – alternative work test

|

The Government announced in the Budget that it is also supporting new parents whose employment was interrupted by the COVID-19 pandemic by introducing an alternative Paid Parental Leave work test period for a limited time.

Under normal circumstances, parents must have worked 10 of the 13 months prior to the birth or adoption of their child to qualify, but that is being temporarily extended to 10 months out of the 20 months for births and adoptions that occur between 22 March 2020 and 31 March 2021. This measure is estimated to allow about 9,000 mothers to regain eligibility for Parental Leave Pay and allow a further 3,500 people to claim Dad and Partner Pay.

Source: Minister for Social Services media release, 6 October 2020

|

[1102] Totally and Permanently Incapacitated Veterans - rent assistance

| [1102] |

Totally and Permanently Incapacitated Veterans - rent assistance

|